Whether you run a local plumbing business or a national property maintenance company, you know there are three essential qualities to a good supplier:

- Price

- Speed of delivery

- Reliability

Of course, maintaining a healthy relationship with these suppliers depends entirely on what happens after the delivery…

For field service companies, sourcing materials is only half the battle. The other half—and often the source of significant headaches—is effectively handling the flood of incoming bills.

When done manually, this critical financial workflow is fraught with risk.

Slow processing, missed payment deadlines, costly double data entry, and the confusion of mismatched purchase orders can strain cash flow and damage vital supplier relationships.

To move past this tedious, error-prone cycle, contractors must adopt a digital, integrated approach.

This is where field service management software becomes essential.

This blog will define vendor invoice management, expose the common pitfalls of outdated methods, and demonstrate how leveraging a dedicated solution—like Commusoft—provides the automation and accuracy needed to transform your accounts payable process from a liability into an efficient engine for growth.

What is Vendor Invoice Management?

Vendor invoice management is the process of receiving, validating, and paying invoices from your suppliers in a timely and accurate manner.

Most contractors will receive vendor invoices regularly from their preferred parts retailers and enter them into an Accounts Payable, increasing their credit balance.

An open vendor invoice is an invoice that hasn’t been paid. When it’s cleared, the Accounts Payable amount is reduced by the debit amount they paid.

This means a credit balance in Account Payable is made up of open vendor invoices.

Why do you Need Vendor Invoice Management?

If you have a strong partnership between your trades business and your supplier, everyone stands to win, including your customers.

The fact of the matter is, though, that field service companies are also responsible for paying their bills, paying them quickly, and paying them reliably.

Of course, as in any relationship, all parties involved are equally responsible for ensuring it continues positively.

This means that, if you go looking for a new supplier because your current one failed on their part in those promises, you have to be able to prove you weren’t at fault, too.

The next step after this is to do your research and choose your vendors more wisely.

Without a good understanding of vendor invoice management, you run the risk of being left in the dark when dealing with your parts suppliers.

How Should you Manage Vendor Invoices?

Your preferred accounting software—whether that’s Quickbooks, or another integration—will come with a feature to create, manage, and record vendor invoices.

However, as a contractor, the easiest way to organize them is to generate them using your job management software.

In this way, you can take advantage of recorded inventory information, and existing quotes, and have a hold on the full process.

After an invoice is generated, some software will ask you to send it manually, via email, to your preferred supplier, while others offer direct integrations where the invoice goes out automatically.

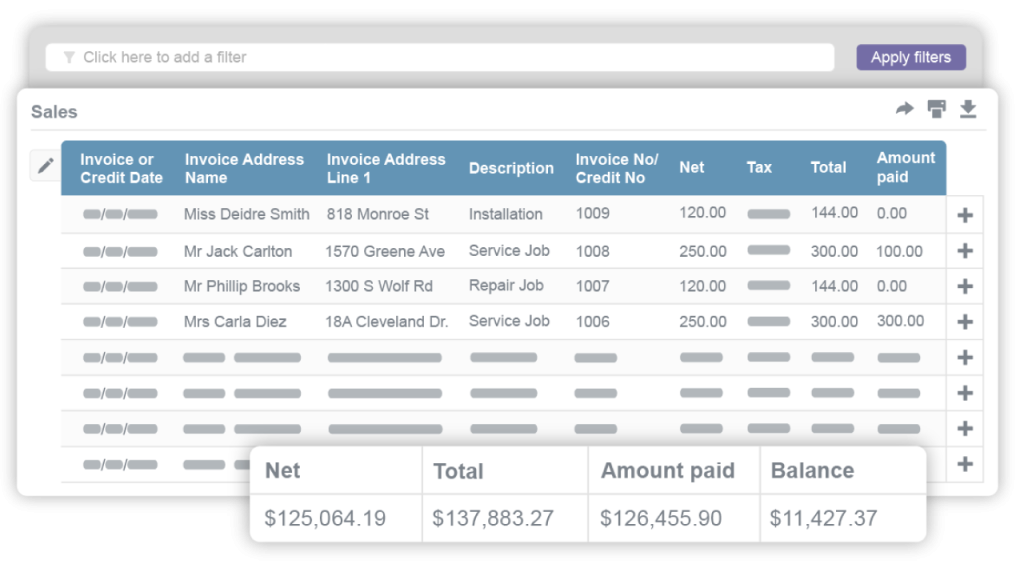

Reporting tools are also generally available so that you can see at a glance how many invoices you’ve sent, how many have been paid, etc.

When it comes to who manages vendor invoices, that depends on your company structure.

Smaller contractors usually have generic admin employees who deal with all types of invoices and a variety of other tasks, plus a part-time accountant who comes in to help regularly but doesn’t work full-time.

Small-to-medium businesses will have someone who manages finances specifically and full-time, while larger businesses have entire departments dedicated to this task.

When it comes to management methods, there are four main categories:

- Manual invoice management, where everything is done on paper. Double data entry and errors are abundant, but the barrier of entry is very low – anyone can do it. An invoice template is especially useful in this scenario.

- Hybrid invoice management, where an accounting software is used without any general management digital tool, so paper records are still kept. This is slightly better than manual invoicing, but not by much because time is still wasted on paperwork, and storing physical records is risky.

- Digital invoice management, where a job management software with an accounting integration is used in tandem for all invoicing activities. The gold standard nowadays, it ensures accurate record keeping, keeps costs low, and employees efficient. It’s especially useful to explore for your plumbing or electrical business, for instance.

- Automated digital invoice management, where the job management software has automation features like consolidated invoicing that can link invoices with POs and jobs on its own, and generate detailed reports. This is for businesses that truly value the quality of their work and aim to grow.

What Information is Included on a Vendor Invoice?

There are a few essential things a vendor invoice should contain:

- Vendor name

- Vendor details (address, phone, contact number)

- A “Billed to” section where your company name & details should go

- Invoice number

- Invoice due date

- A table listing the parts you’ve purchased (name, description, code, price, quantity, etc.)

- A sub-total cost, which represents the amount you have to pay, not including tax

- Tax amount owed

- Total due

- Signature space

- Date issued

Vendor invoices will vary from this template but these are some essential information they should always include.

How do I get an Invoice from a Vendor?

When you’ve created and sent a purchase order for a list of parts, it’s the vendor’s responsibility to send back an invoice.

Otherwise, an email to your account manager should be enough of a nudge.

Make sure to include the purchase order number so that they’re able to search for it in their own system.

Who Should Check Vendor Invoices for Accuracy?

When it comes to vendor invoice accuracy, the main responsibility falls on the vendors themselves.

At the same time, it’s good business practice for your admin, an accountant, or a finance manager to review invoices, too, since it saves you a lot of trouble in the future.

If there is indeed an error on your vendor’s invoice, waiting for them to notice and inform you isn’t the best way to manage your finances. They might even prefer not to inform you of it, unless you’re underpaying.

Ideally, you’d be able to link your purchase orders to your vendor invoices automatically so that you’re always aware of what you ordered and what you’re actually paying for.

This process is known as three-way matching. Ideally, you’d use software to automatically link your purchase orders, delivery notes, and vendor invoices to ensure you only pay for what you actually received.

How Long Should it take for a Vendor to Send an Invoice?

This depends on the type of contract you’ve signed with your vendor and your state laws, but most written purchase contracts will have a four-year statute of limitation.

Legally, a vendor has up to four years to invoice you until they lose the right to claim payment.

However, as you can imagine, this is no way to run a business and most vendors like to be paid promptly so they’ll invoice you as soon as possible, usually within a working week.

If you’re dealing with large suppliers and you order in bulk, they can invoice you for all the parts (a consolidated invoice) at a set date (e.g. at the end of each month, at the end of a quarter, etc.), just like you would with a property maintenance contract.

Ideally, you would discuss these terms and conditions when you open a business account with a vendor so that there’s no confusion on either side.

Remember that any friction in your parts purchasing process translates as friction in your customer journey!

How Long Should I Keep Vendor Invoices?

It’s recommended by the IRS to keep records referring to business income or deductions (like invoices) for as long as their statute of limitations runs. This way, you always have a (digital) paper trail to fall back on if you ever need to prove a payment. Following up on the previous point, you should keep vendor invoices for four years, but, again, this depends mostly on the type of contract you’ve signed and your state laws.

At the same time, it’s good management to keep records and to make sure these are:

- Organized according to a formal structure

- Efficient, meaning it doesn’t take forever and a day to file

- Easy to understand even to a new hire. Many contracting businesses will have had the same admin person for years if not decades, so when suddenly they find themselves needing to hire someone new, they may realize none of the record-keeping makes sense to anyone but their old hire!

The best practice when keeping records of vendor invoices is to save them on your cloud-based software (so accessible from any computer and not dependent on a hard copy that can easily be lost or destroyed) and link them up to their corresponding purchase orders.

This will help you with budgeting later down the line.

What Deductions Can Vendors Allows on an Invoice?

Some vendors might allow a deduction which shows up on the invoice if you’re able to pay before the deadline.

This is called a rebate and the goal is to encourage you to clear the invoice quicker, which contributes to the vendor’s healthy cash flow.

It’s up to you if you want to take advantage of these rebates.

On one hand, it can end up being cheaper to buy parts like this, but on the other, if your cash flow can’t support it, you might end up using money you don’t have.

What’s more, that money has to come from somewhere and if you bail on paying other invoices, you might end up spending the savings on fines or interest accrued from these debts.

What are some Common Problems with Vendor Invoicing?

Below, then, are some of the most common problems that can get in the way of managing supplier invoices and our tips for fixing them:

- Suppliers format their invoices differently

You could be forgiven for thinking, then, that so long as you have all the details you need to process an invoice, there’s no harm in it taking a little extra admin time to sort out.

However, it’s often the case that the impact of “just a little each time” can add up to a whole lot, in the long run.

- Human error causes confusion

Something as simple as inputting the wrong digit can cause a cascade that hurts productivity, all because you now have to waste time calling back an invoice, chasing money that shouldn’t have gone out, or handle irate service calls; all of which can even go so far as to damage your reputation.

- Double data entry is time-consuming

The more screens you have to work with, the more time your admin will have to waste on entering the same information over and over again.

The latter might not look like such a big concern at first, but tedious, repetitive, and redundant tasks are a big source of employee burnout and turnover, both of which can cost you a pretty penny.

- Raising invoices can only be done in the office

Going back to an issue we raised earlier, if you’re not yet using cloud software, you’re tied to an office desk for any invoicing-related activity, vendors included.

Measuring Success: Vendor Management KPIs

You can’t improve what you can’t measure—and you can’t easily measure vendor invoices (especially at volume) with paper.

So, if you’re looking to improve invoicing, you need to measure your performance against a set key performance indicators (KPIs).

A digital solution can allow you to run reports on:

- Processing Time: How long it takes to go from “invoice received” to “invoice paid.”

- Error Rates: Tracking how often duplicate payments or pricing errors occur.

- Discounts Captured: The dollar amount saved by hitting “early payment” windows.

- Cost Per Invoice: The administrative time spent handling a single bill.

Why this matters: With Commusoft’s reporting and analytics features, you don’t have to hunt for this data.

It’s much easier to spot errors and see where you’re slowing down and even where you’re losing money.

Managing Vendor Invoices with with Commusoft

Good vendor invoice management practices can provide you with better parts prices, lower admin costs, and more reliable services.

All these play a part in offering a remarkable customer experience, with quick project turn-arounds, and quality work.

This being said, if you try to do it manually. it does take effort to organize and keep an eye on every incoming invoice, making sure they’re always accurate and paid on time.

It’s why invoicing software for field services is so important.

One way to lower your invoicing costs and help your employees make better use of their time is to make full use of your management software’s invoicing features.

Drag and drop documents in, import and link them to specific purchase orders, and even edit them all on a single screen.

For that and much more, check out schedule a call and speak with our team, today!